Nail your DAO — A Guide to Treasury Management

Steps and Resources to Effectively Manage DAO Treasury

Founding and managing a DAO can be a lot of work, we get it!

DAOs have disrupted top-down legacy models used in business for a more community-driven and ideological way of operating. The downside to this is that the space is still young, unregulated, and there are very little tools that address their unique needs.

However, when it comes to managing treasury, there are few guidelines. Unlike corporate finance which has existed since longer than we can remember, DAO treasury is a very new concept with its own implications. Unfortunately, many DAO Treasurers “winging it” and hoping that things go well.

Although we’re not a DAO, we have many DAOs who use Multis and who have shared their best practices with us especially when it comes to treasury management.

Review fundamental concepts in DAO Treasury Management

No matter your organization type, there are two key concepts for treasury management:

Think Long Term: DAO managers are often thinking in terms of cycles or sprints, given the nature of their activity. The most successful DAOs build a community for the long term. The same should be applied to the way DAOs manage their treasury.

Diversify your portfolio: Portfolio diversification is the first rule that should be respected to hedge against risk and asset price volatility, which in the case of crypto market, we all know is very high.

Store your DAO Treasury Safely

Almost all DAOs use Multisigs to store their treasury. Multisigs allows DAOs to transact collaboratively by offering the following advantages :

Security: Multisigwallets lock your funds into a smart contract, and all transactions can be verified on-chain. No funds are held in the browser and there is no wallet provider managing your private keys.

Team collaboration: Multisigs give you a way to form a “shared ownership” over one company wallet. Wallet owners can invite other teammates to have access to wallet as well.

Built-in Key recovery: In case of private key loss, other owners can help you retrieve access to the wallet through inviting your new account to the multisig.

We recommend storing with Gnosis Safe- which is the gold standard in Treasury Management.

We love Gnosis Safe so much that we built on it. Gnosis Safe has some unique features that make it a top operating system for DAOs:

Open Source:Gnosis Safe is open source, which means you can dig into the code or add custom modules to your safe.

Safe Apps: an ecosystem of Dapps accessible from within the Gnosis Safe interface, which enables users to connect their Safe account to a dapp for secure interaction using their predefined multisig policy.

Formal verification audit: Gnosis implements formal verification process to audit the code and protect it from vulnerabilities and hacks.

Over $100 billion in assets are stored securely on Gnosis Safes and it’s widely trusted in the DAO Space.

Diversify Your Treasury

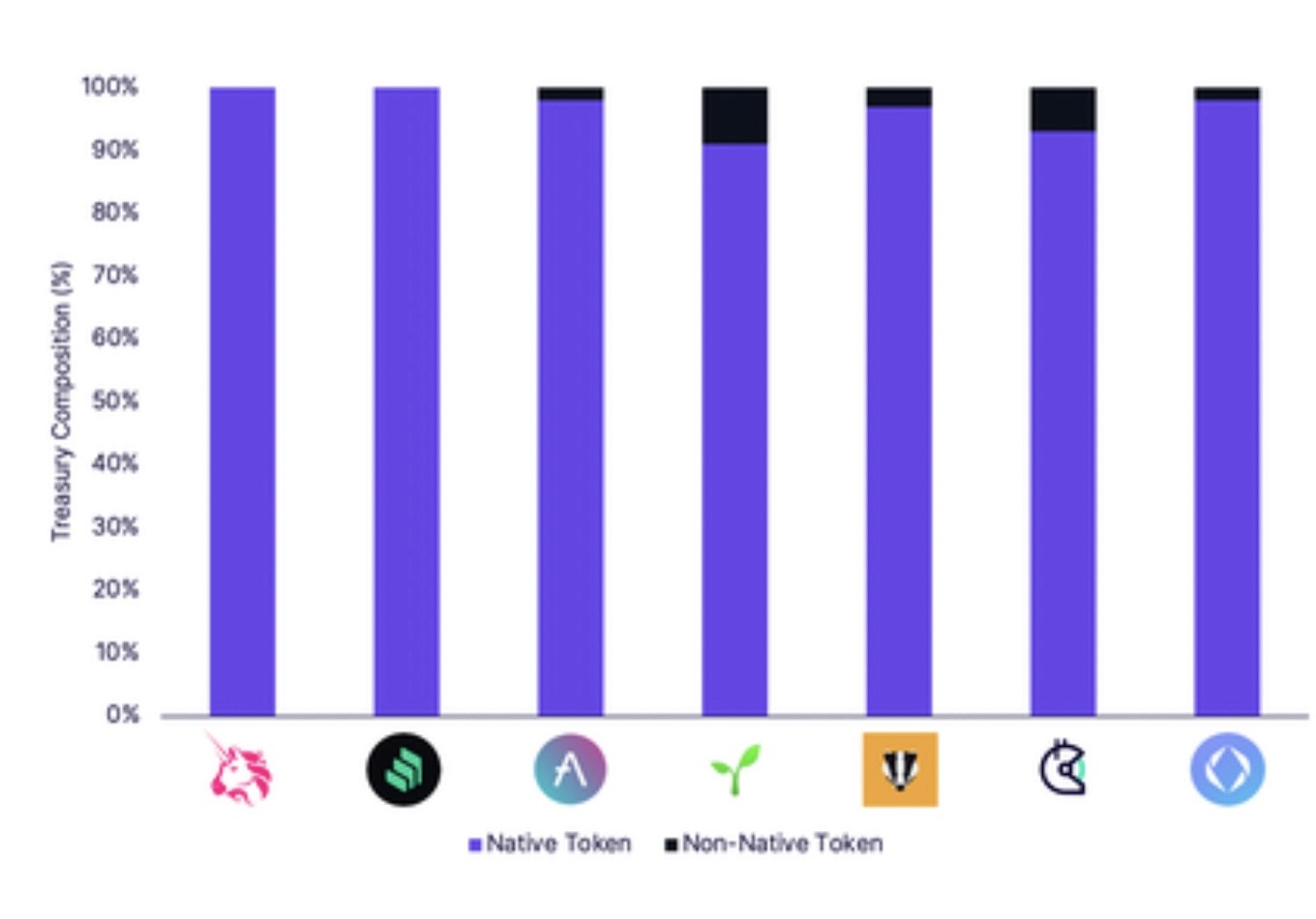

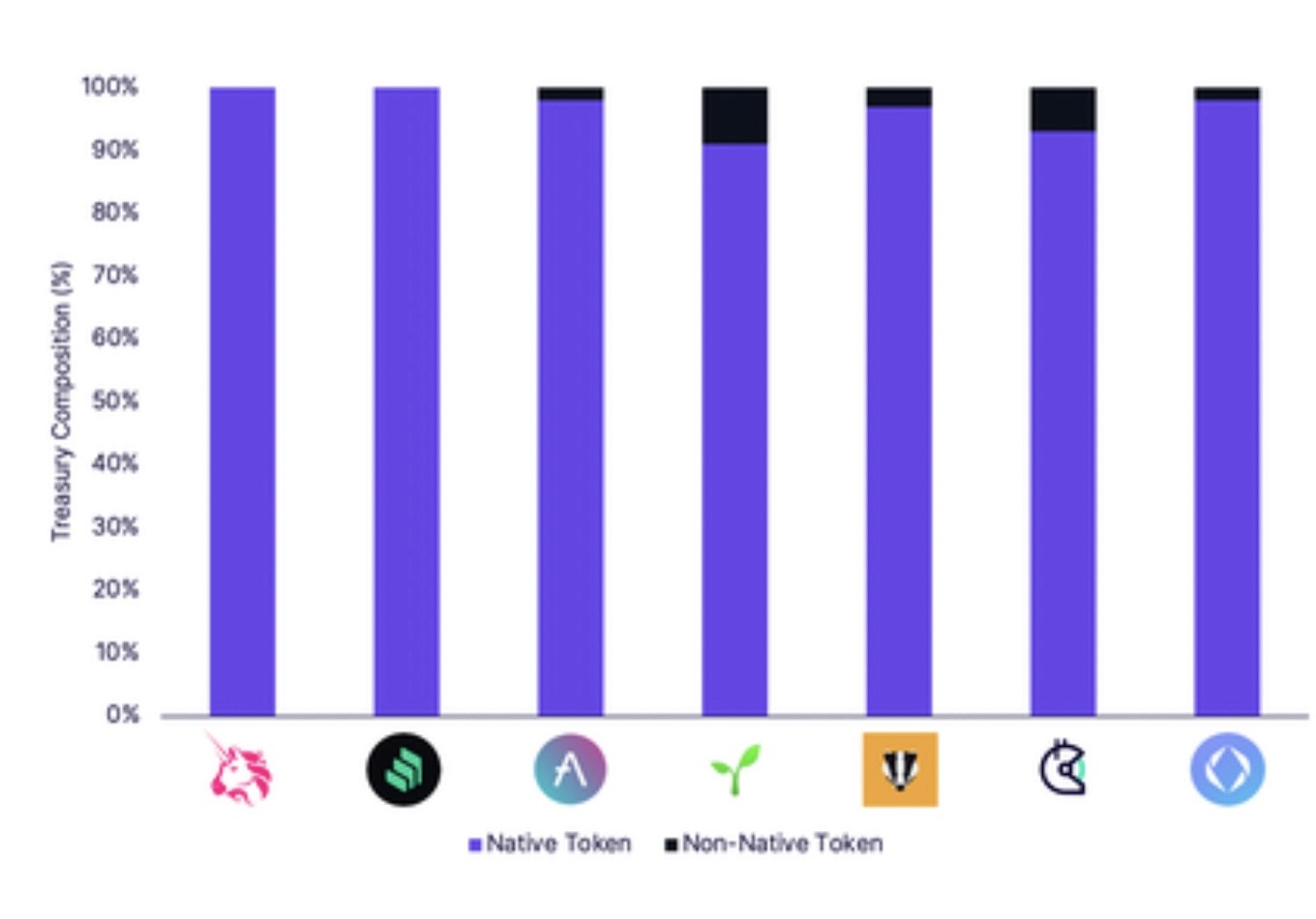

At first glance, it seems intuitive for DAOs to keep a large percentage of their treasury in native tokens — since that’s also what some of the most prominent DAOs are doing.

Of course this is highly risky: if you are only holding your native token in your portfolio, and for some reason (management, marketing, competition, a bear market), its value goes down by 30%, then the value of your whole treasury will shrink by 30%. This is catastrophic for any organization, decentralized or not, and DAOs should be able to meet their financial obligations at all times.

That’s why it is advised to keep a percentage of your treasury in less volatile currencies. Stablecoins are a must have. Setting aside an amount of stablecoins is a very effective way to protect yourself from default and offsetting your operational expenses.

4 Ways To Diversify Your Treasury into Stablecoins

Over the counter (OTC): OTC sales allow you to exchange your tokens directly without going through secondary markets. This process can be realized between the DAO and its community directly. Tokens can also be sold directly to institutional investors. This method allows DAOs to respect their vesting schedules and has the least impact on token price.

At market selling: This implies selling your tokens at the best available price. Even though this method is fast in execution, it might send negative signals to your stakeholders, especially if you are selling in large amounts. In consequence, it might drive the token price downward. We don’t recommend DAOs do this.

Conditional order strategies: Is an advanced version of “at market selling” where you can rely on condition-based orders to pick the right time for your token sale.

DeFi — Financial derivatives: Creating a collaterlized debt position, using DeFi protocols such as UMA’s range token, Visor or leveraging income generating protocols like Ribbon’s Treasury Vaults are also examples of ways to diversify your treasury into stablecoins.

If you’re looking for inspiration on Treasury Diversification we recommend studying these proposals:

Treasury Diversification Tools: A look at Hedgey

Hedgey is tackling two of the 4 diversification strategies, with its OTC protocol and Treasury Pools Conditional Calls protocol. Both of these protocols have their place in treasury management for DAOs, depending on their maturity, scale, community and treasury needs.

OTC Protocol: Their OTC protocol allows new DAOs to sell tokens even before they have an AMM liquidity pool to their first community and investors. Additionally, the OTC protocol ties into a token-time-lock protocol, which allows the DAO to sell the tokens in a way which locks up the sold tokens for a given time frame. This ensures that the investors cannot simply dump the tokens, and allows for long term incentive alignments, which means the DAO can feel confident and comfortable offering token discount deals with time locks to their community. For the investor — their tokens are locked in an NFT with some fun visuals attached, which can be traded on secondary market places like OpenSea if they need liquidity before redemption date.

Treasury Pools (Covered Calls): The Hedgey Treasury Pools protocol is a way for DAOs to earn yield on their tokens in stable coins selling covered calls, while also providing a responsible and transparent way to let the community purchase tokens at a set price. This protocol allows any token to participate, setting a strike, maturity and premium price that makes sense for both the DAO and the community buyers; and there is no requirement to have perpetuals or even AMM liquidity. This product is a financial derivative, so it can come in handy for DAOs that have the time for more hands on and active approach to their treasury management and diversification.

Empower Treasury Experts within Your DAO

“Early on in our community all treasury decisions had to have a proposal and discussion community wide. This process ended up being time consuming and distracting. We decided to deploy a voting mechanism to elect a committee who mandate spending treasury funds and sets budgets. They work autonomously and only consult the larger community about major decisions” — Prudent Anon, Chief Farming Officer at Pickle DAO.

The hyper democratic nature of DAOs is great but it can make processes slow if everything gets voted on by the community, especially when it comes to treasury management.

That’s why we recommend delegating treasury related matters to a committee of elected members — who are usually elected based on the degree of their contribution and value added to the DAO. Sourcing and empowering DAO members who have an expertise in treasury management or an interest in market dynamics is a first step for more effective treasury management. The a committee can handle day to day treasury ops and will consult the community for important decisions. Once you’ve set up your Treasury Committee, you should consider:

Organizing your objectives into sprints: you should have a short time-span, between 3–6 months, to allow for more thorough monitoring and reporting.

Voting (on decisions) criteria should be known and shared with everyone.

Token holders should be able to discuss the restriction and termination of power.

Documenting all the decisions and keeping a record of the all the amendments and votes.

Earn Your Community's Trust with Financial Reporting

We strongly believe that financial reporting is the most powerful tool for any organization.

You could go ahead and implement all the processes we mentioned above, however it wouldn’t serve its purpose if it wasn’t accompanied with thorough financial reporting.

We encourage regular reporting to your community. A monthly or quarterly report will help your contributors feel part of the project and earn trust in the DAO, through having the same visibility over the DAO’s Finances: being able to forecast, understand flow of funds, and where they are with a budget.

Major events (Token sales, M&As, etc..) should be well-explained and communicated before the voting takes place.

We enjoyed reading the Treasurer series by Alex Michelsen from Hedgey. He says:

“No matter where your DAO is, however, transparency with the members and community is critical as part of the budgeting process. If you are looking at development costs specifically, a great template to check out is the employee compensation template maintained by DxDAO, who transparently communicates the costs and salaries paid for employees, and gives a basic outline of the various skill levels for each tier.” — Great stuff, we recommend you read it too!

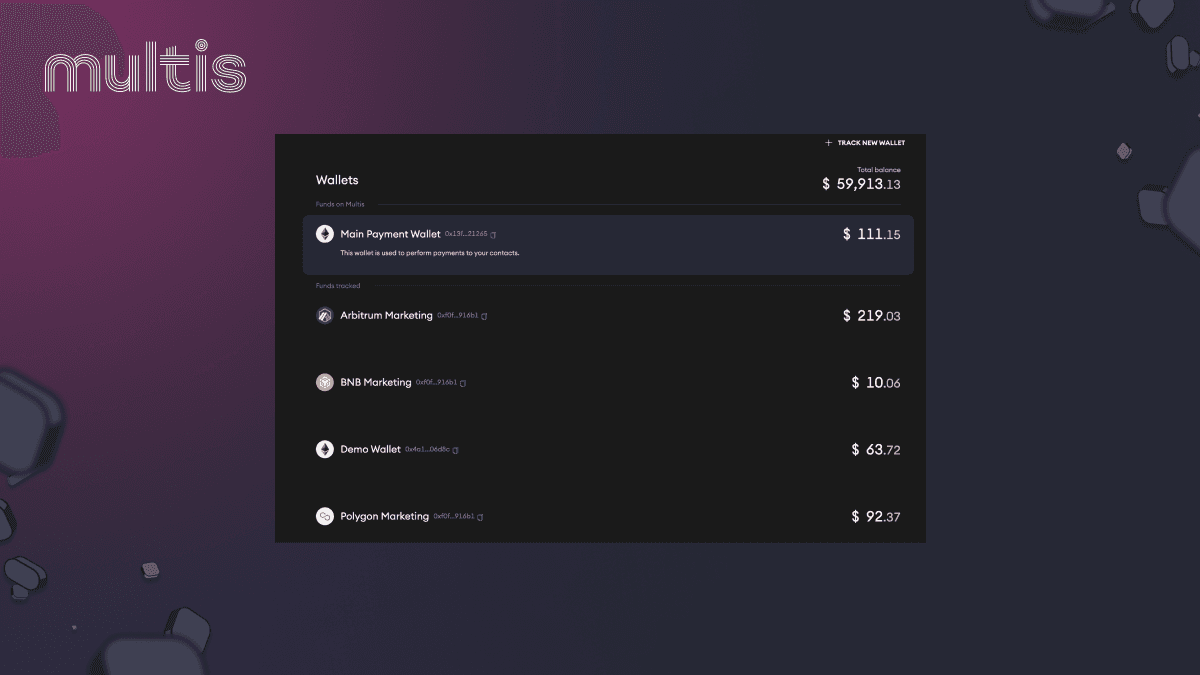

Multis Makes DAO Treasuries Easy to Manage

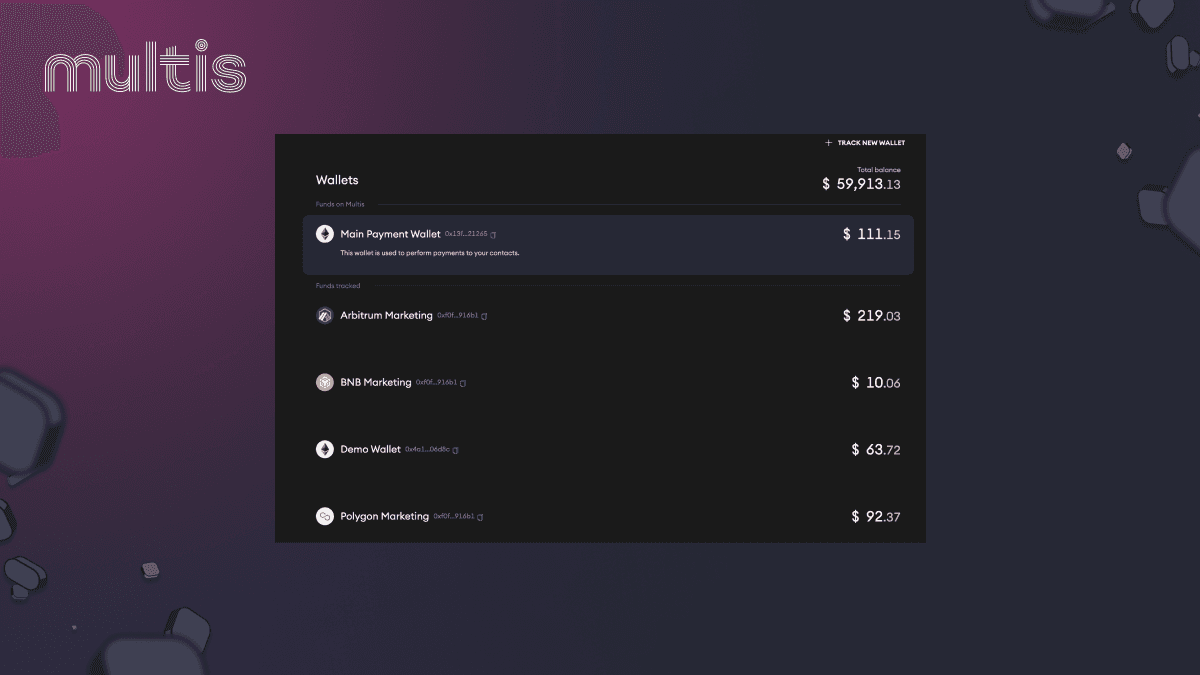

We built Multis for DAO treasury committees who are interested in getting control and clarity over their DAO’s finances. Multis accounts have features that are perfect for DAOs, including:

Link an existing Gnosis Safe: No need to move your treasury and start all over again. When setting up your account, link to your MetaMask and all the data will be retrieved and displayed in our holistic dashboard.

Bulk Pay: With Multis you can save time on your payroll and pay up to 65 different wallet addresses.

Track & Monitor all your wallets crosschain: On Multis accounts you can upload wallets from ETH, Polygon, BNB, Arbitrum, Optimism, and BTC chains. Wallets can be hot wallets, keys wallets, or other multisigs. All activity is tracked and the account serves as a single source of truth.

Categorize and Label Transactions: Forget about spending hours between excel and etherscan. Categorize your transactions as they occur and and get a deeper understanding of your most categorizec transactions in our Insights section.

Export your data as a CSV document for accounting purposes: Reconcile your financial data with accounting software using our “export as a CSV” feature to help your DAO align with accounting and legal regulations.

Visualize inflows and outflows: Multis gives you real-time visibility over your cashflows.

Shared company address book: Add your contributor’s addresses to your contact book and spare time on manual entries.

While you should be doing regular budgeting and financial reporting-we think that sharing treasury insights (and not hard to read reports) with your community members is a great way to help them understand flow of funds and set your DAO up for success. Create an account for free to get a handle on your DAO’s treasury.

More Resources on DAO Treasury Management to Help You Take Your DAO to The Moon

As DAOs enter the mainstream, more time and attention is being paid to the topic of treasury management. If you want more resources, check out the links below and let us know if we’ve left anything out!

DAO Treasury/Balance Sheet Management — Blockchain Capital

Why DAOs Need To Diversify — Bankless

A Guide to DAO Treasury Diversification — Justin McAfee

Steps and Resources to Effectively Manage DAO Treasury

Founding and managing a DAO can be a lot of work, we get it!

DAOs have disrupted top-down legacy models used in business for a more community-driven and ideological way of operating. The downside to this is that the space is still young, unregulated, and there are very little tools that address their unique needs.

However, when it comes to managing treasury, there are few guidelines. Unlike corporate finance which has existed since longer than we can remember, DAO treasury is a very new concept with its own implications. Unfortunately, many DAO Treasurers “winging it” and hoping that things go well.

Although we’re not a DAO, we have many DAOs who use Multis and who have shared their best practices with us especially when it comes to treasury management.

Review fundamental concepts in DAO Treasury Management

No matter your organization type, there are two key concepts for treasury management:

Think Long Term: DAO managers are often thinking in terms of cycles or sprints, given the nature of their activity. The most successful DAOs build a community for the long term. The same should be applied to the way DAOs manage their treasury.

Diversify your portfolio: Portfolio diversification is the first rule that should be respected to hedge against risk and asset price volatility, which in the case of crypto market, we all know is very high.

Store your DAO Treasury Safely

Almost all DAOs use Multisigs to store their treasury. Multisigs allows DAOs to transact collaboratively by offering the following advantages :

Security: Multisigwallets lock your funds into a smart contract, and all transactions can be verified on-chain. No funds are held in the browser and there is no wallet provider managing your private keys.

Team collaboration: Multisigs give you a way to form a “shared ownership” over one company wallet. Wallet owners can invite other teammates to have access to wallet as well.

Built-in Key recovery: In case of private key loss, other owners can help you retrieve access to the wallet through inviting your new account to the multisig.

We recommend storing with Gnosis Safe- which is the gold standard in Treasury Management.

We love Gnosis Safe so much that we built on it. Gnosis Safe has some unique features that make it a top operating system for DAOs:

Open Source:Gnosis Safe is open source, which means you can dig into the code or add custom modules to your safe.

Safe Apps: an ecosystem of Dapps accessible from within the Gnosis Safe interface, which enables users to connect their Safe account to a dapp for secure interaction using their predefined multisig policy.

Formal verification audit: Gnosis implements formal verification process to audit the code and protect it from vulnerabilities and hacks.

Over $100 billion in assets are stored securely on Gnosis Safes and it’s widely trusted in the DAO Space.

Diversify Your Treasury

At first glance, it seems intuitive for DAOs to keep a large percentage of their treasury in native tokens — since that’s also what some of the most prominent DAOs are doing.

Of course this is highly risky: if you are only holding your native token in your portfolio, and for some reason (management, marketing, competition, a bear market), its value goes down by 30%, then the value of your whole treasury will shrink by 30%. This is catastrophic for any organization, decentralized or not, and DAOs should be able to meet their financial obligations at all times.

That’s why it is advised to keep a percentage of your treasury in less volatile currencies. Stablecoins are a must have. Setting aside an amount of stablecoins is a very effective way to protect yourself from default and offsetting your operational expenses.

4 Ways To Diversify Your Treasury into Stablecoins

Over the counter (OTC): OTC sales allow you to exchange your tokens directly without going through secondary markets. This process can be realized between the DAO and its community directly. Tokens can also be sold directly to institutional investors. This method allows DAOs to respect their vesting schedules and has the least impact on token price.

At market selling: This implies selling your tokens at the best available price. Even though this method is fast in execution, it might send negative signals to your stakeholders, especially if you are selling in large amounts. In consequence, it might drive the token price downward. We don’t recommend DAOs do this.

Conditional order strategies: Is an advanced version of “at market selling” where you can rely on condition-based orders to pick the right time for your token sale.

DeFi — Financial derivatives: Creating a collaterlized debt position, using DeFi protocols such as UMA’s range token, Visor or leveraging income generating protocols like Ribbon’s Treasury Vaults are also examples of ways to diversify your treasury into stablecoins.

If you’re looking for inspiration on Treasury Diversification we recommend studying these proposals:

Treasury Diversification Tools: A look at Hedgey

Hedgey is tackling two of the 4 diversification strategies, with its OTC protocol and Treasury Pools Conditional Calls protocol. Both of these protocols have their place in treasury management for DAOs, depending on their maturity, scale, community and treasury needs.

OTC Protocol: Their OTC protocol allows new DAOs to sell tokens even before they have an AMM liquidity pool to their first community and investors. Additionally, the OTC protocol ties into a token-time-lock protocol, which allows the DAO to sell the tokens in a way which locks up the sold tokens for a given time frame. This ensures that the investors cannot simply dump the tokens, and allows for long term incentive alignments, which means the DAO can feel confident and comfortable offering token discount deals with time locks to their community. For the investor — their tokens are locked in an NFT with some fun visuals attached, which can be traded on secondary market places like OpenSea if they need liquidity before redemption date.

Treasury Pools (Covered Calls): The Hedgey Treasury Pools protocol is a way for DAOs to earn yield on their tokens in stable coins selling covered calls, while also providing a responsible and transparent way to let the community purchase tokens at a set price. This protocol allows any token to participate, setting a strike, maturity and premium price that makes sense for both the DAO and the community buyers; and there is no requirement to have perpetuals or even AMM liquidity. This product is a financial derivative, so it can come in handy for DAOs that have the time for more hands on and active approach to their treasury management and diversification.

Empower Treasury Experts within Your DAO

“Early on in our community all treasury decisions had to have a proposal and discussion community wide. This process ended up being time consuming and distracting. We decided to deploy a voting mechanism to elect a committee who mandate spending treasury funds and sets budgets. They work autonomously and only consult the larger community about major decisions” — Prudent Anon, Chief Farming Officer at Pickle DAO.

The hyper democratic nature of DAOs is great but it can make processes slow if everything gets voted on by the community, especially when it comes to treasury management.

That’s why we recommend delegating treasury related matters to a committee of elected members — who are usually elected based on the degree of their contribution and value added to the DAO. Sourcing and empowering DAO members who have an expertise in treasury management or an interest in market dynamics is a first step for more effective treasury management. The a committee can handle day to day treasury ops and will consult the community for important decisions. Once you’ve set up your Treasury Committee, you should consider:

Organizing your objectives into sprints: you should have a short time-span, between 3–6 months, to allow for more thorough monitoring and reporting.

Voting (on decisions) criteria should be known and shared with everyone.

Token holders should be able to discuss the restriction and termination of power.

Documenting all the decisions and keeping a record of the all the amendments and votes.

Earn Your Community's Trust with Financial Reporting

We strongly believe that financial reporting is the most powerful tool for any organization.

You could go ahead and implement all the processes we mentioned above, however it wouldn’t serve its purpose if it wasn’t accompanied with thorough financial reporting.

We encourage regular reporting to your community. A monthly or quarterly report will help your contributors feel part of the project and earn trust in the DAO, through having the same visibility over the DAO’s Finances: being able to forecast, understand flow of funds, and where they are with a budget.

Major events (Token sales, M&As, etc..) should be well-explained and communicated before the voting takes place.

We enjoyed reading the Treasurer series by Alex Michelsen from Hedgey. He says:

“No matter where your DAO is, however, transparency with the members and community is critical as part of the budgeting process. If you are looking at development costs specifically, a great template to check out is the employee compensation template maintained by DxDAO, who transparently communicates the costs and salaries paid for employees, and gives a basic outline of the various skill levels for each tier.” — Great stuff, we recommend you read it too!

Multis Makes DAO Treasuries Easy to Manage

We built Multis for DAO treasury committees who are interested in getting control and clarity over their DAO’s finances. Multis accounts have features that are perfect for DAOs, including:

Link an existing Gnosis Safe: No need to move your treasury and start all over again. When setting up your account, link to your MetaMask and all the data will be retrieved and displayed in our holistic dashboard.

Bulk Pay: With Multis you can save time on your payroll and pay up to 65 different wallet addresses.

Track & Monitor all your wallets crosschain: On Multis accounts you can upload wallets from ETH, Polygon, BNB, Arbitrum, Optimism, and BTC chains. Wallets can be hot wallets, keys wallets, or other multisigs. All activity is tracked and the account serves as a single source of truth.

Categorize and Label Transactions: Forget about spending hours between excel and etherscan. Categorize your transactions as they occur and and get a deeper understanding of your most categorizec transactions in our Insights section.

Export your data as a CSV document for accounting purposes: Reconcile your financial data with accounting software using our “export as a CSV” feature to help your DAO align with accounting and legal regulations.

Visualize inflows and outflows: Multis gives you real-time visibility over your cashflows.

Shared company address book: Add your contributor’s addresses to your contact book and spare time on manual entries.

While you should be doing regular budgeting and financial reporting-we think that sharing treasury insights (and not hard to read reports) with your community members is a great way to help them understand flow of funds and set your DAO up for success. Create an account for free to get a handle on your DAO’s treasury.

More Resources on DAO Treasury Management to Help You Take Your DAO to The Moon

As DAOs enter the mainstream, more time and attention is being paid to the topic of treasury management. If you want more resources, check out the links below and let us know if we’ve left anything out!

DAO Treasury/Balance Sheet Management — Blockchain Capital

Why DAOs Need To Diversify — Bankless

A Guide to DAO Treasury Diversification — Justin McAfee