Nail your DAO: How to choose the best business tooling for your DAO

DAOs: huge potential but limited tooling

According to the experts, we’re right now in the year of the DAO (or Decentralized Autonomous Organization). As of February 2022, there are at least 188 DAOs controlling over $12 billion in assets. These organizations have huge potential: they’re digitally native, transparent by design and their community-led ethos means they can often scale faster than traditional top-down organizations. However, a major block in running a DAO is a lack of tooling that can allow for efficient treasury management, payouts, reimbursement, and smooth governance. Traditional businesses have a wide range of Saas products, and business apps to support their operations, in addition to corps of lawyers and accountants specializing in startups and small businesses. This is not yet the case in the web3 world. Below you’ll find some solutions that we’ve seen our users implement and in order to improve upon tools and to create solutions whole cloth.

DAO Treasury Management: Emerging Tooling to cover the basics and to diversify

Nearly all DAOs store their treasury on multisignature wallets, which are built for teams. Although there are a wide array of multisignature wallets, Gnosis Safe is the de-facto multisignature wallet for DAOs. Most DAOs lock up their assets on multiple multisignature wallets and disburse treasury to individual wallets for coindrops or allocating grant funding. We spoke to a member of a grants committee at a major DAO and he summed it up saying “My biggest issue is that most DAO contributors have no understanding of treasury management at all. Lots of funds sit idle because the most important thing with treasury is knowing how to use it.”

Multis: DAO Tooling for Treasury & Cashflow Monitoring

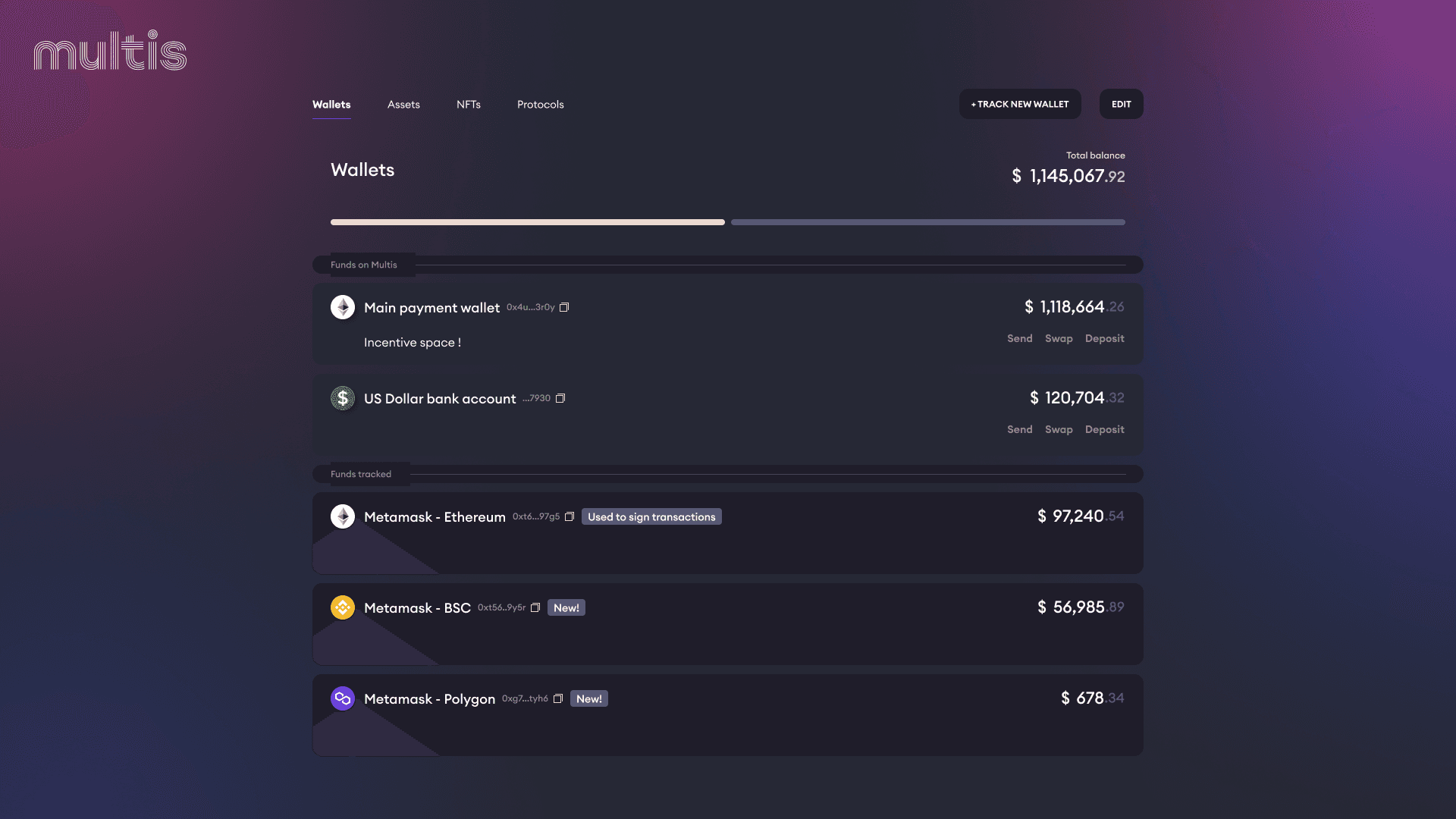

One of the reasons we built Multis was to give DAOs and web3 organizations clarity and control over their crypto treasury. We’ve built our app on Gnosis Safe because not only do we think it’s the gold standard for Multisig wallets but also because DAOs can simply connect their existing safes and access the app. No need to transfer funds to a new wallet.

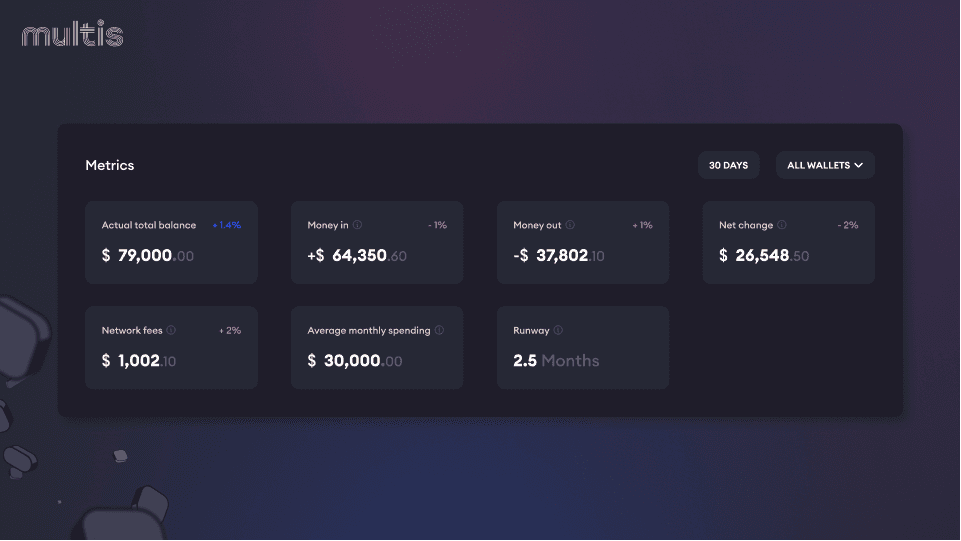

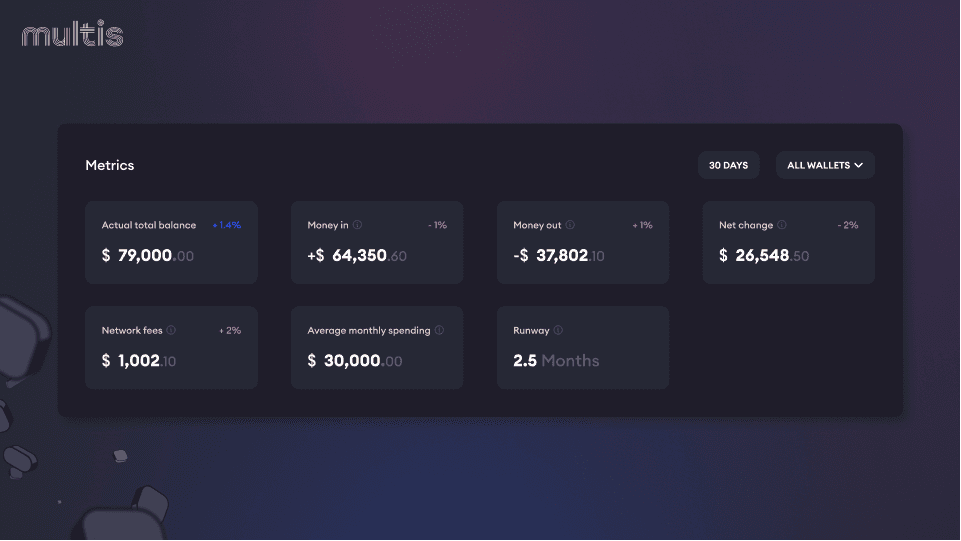

Monitoring Finances and Getting Company Metrics

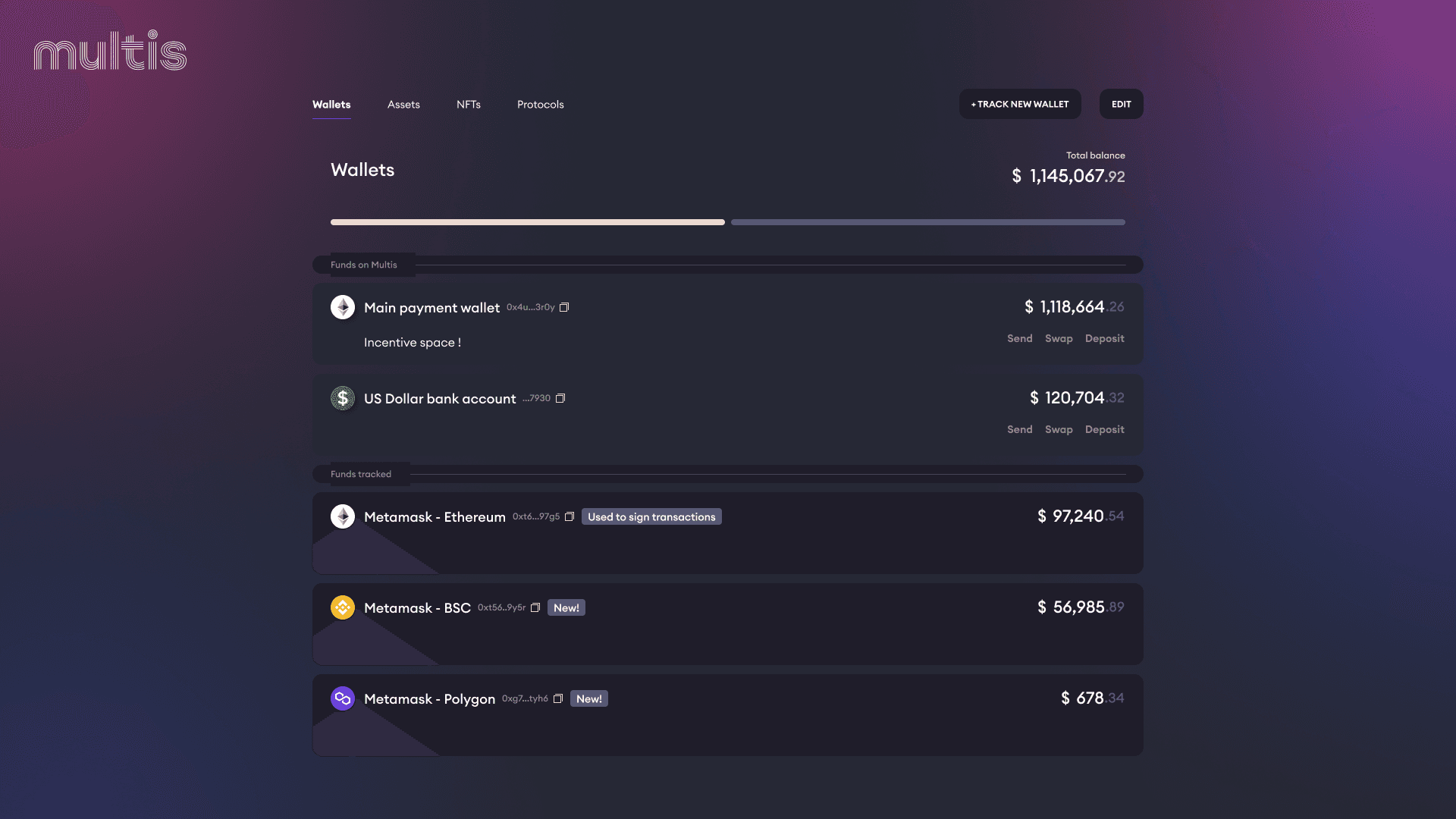

Multis allows teams to track financial activity of wallets across ETH, BNB, Polygon, and BTC. DAOs can link as many wallets as they are using for a holistic overview of their funds. This can be a crucial way for DAOs to make complex financial information easier to read and to understand. Visualizing company treasury over time and by category can help teams make better decisions about cashflow and budgeting and is a crucial step towards getting a handle on your DAO’s treasury.

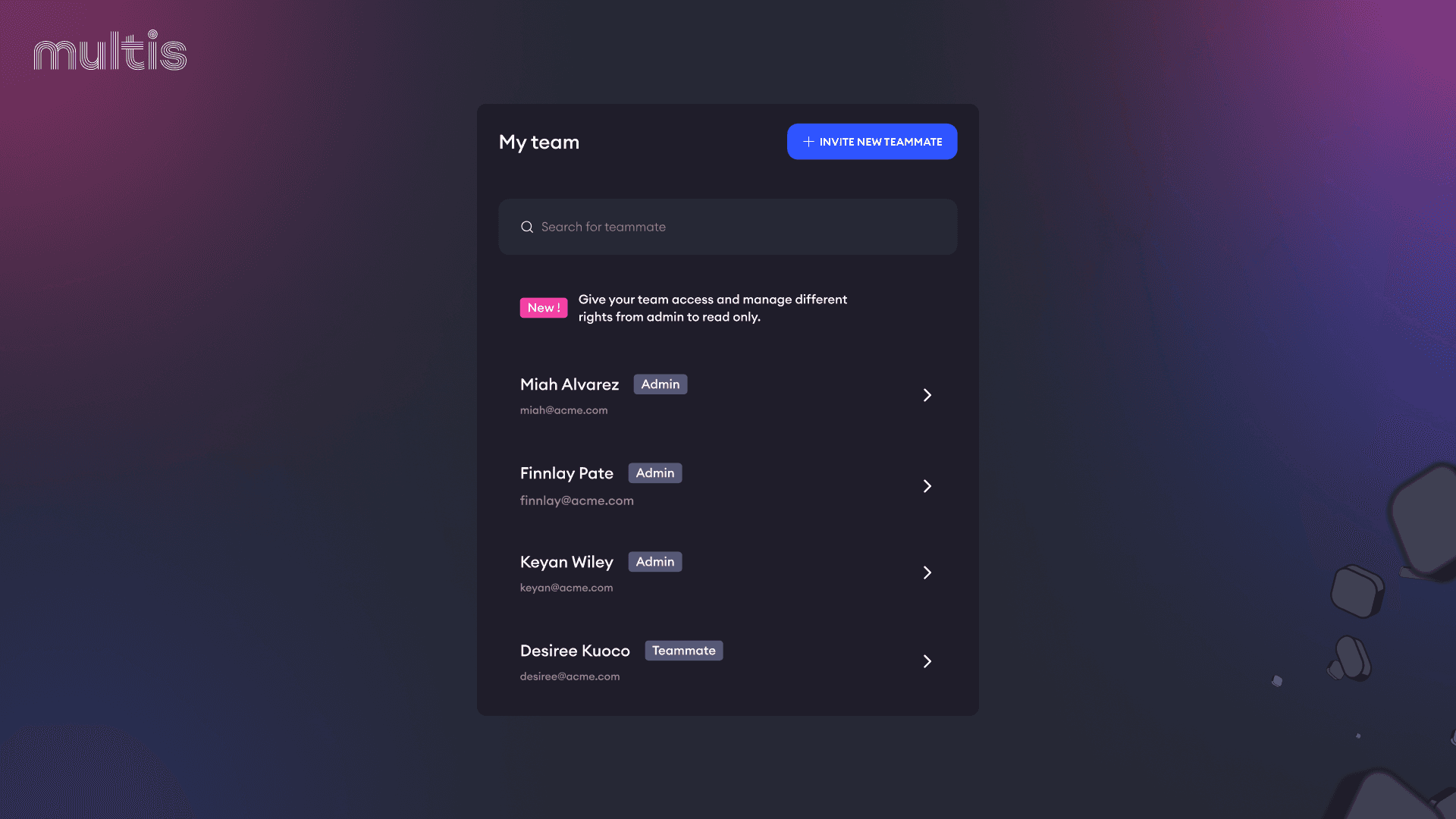

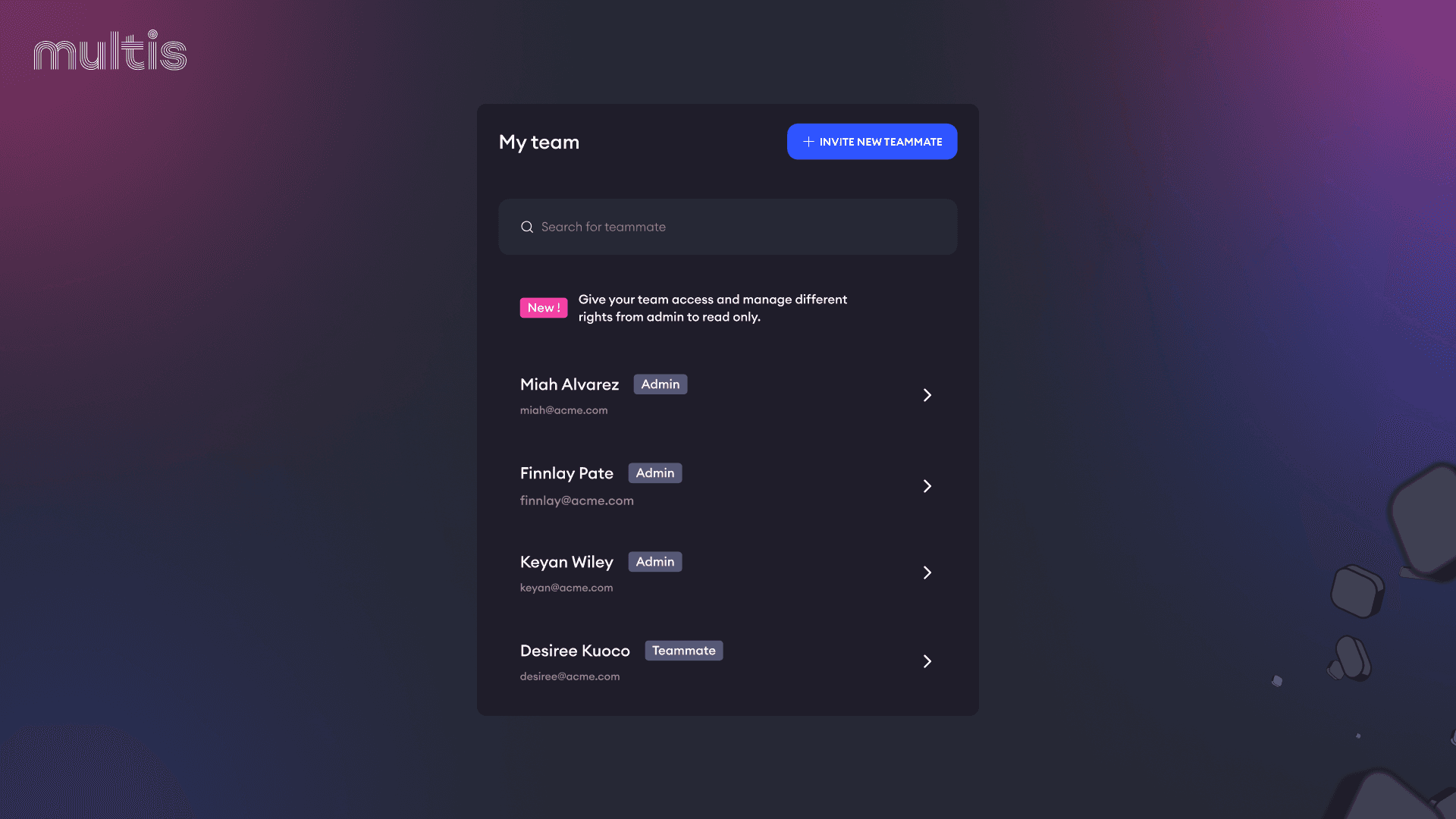

Community access

Unlike a Gnosis Safe, where only “owners” can access funds on the wallet, Multis accounts include a teammate-level access. Meaning that non-owners can still see activity on the wallet, label transactions, and export financial data.

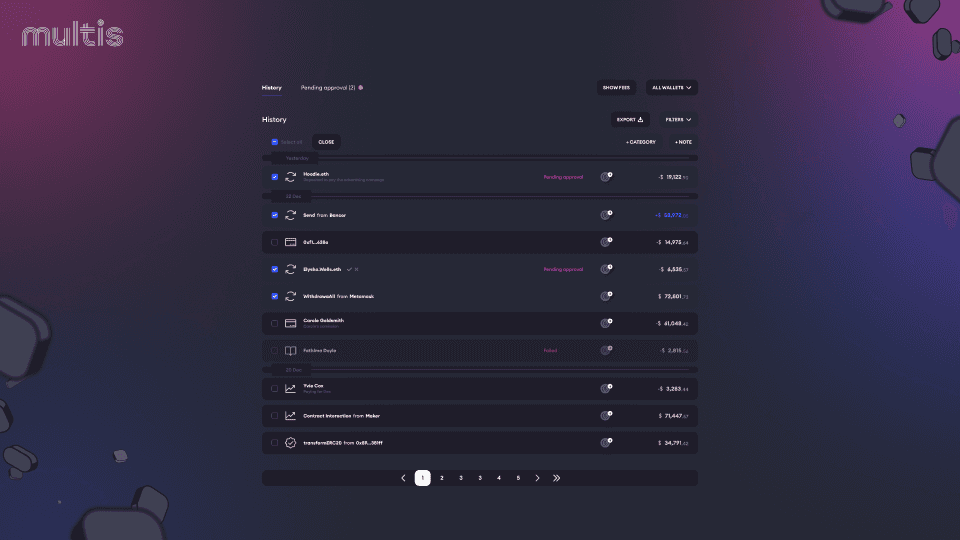

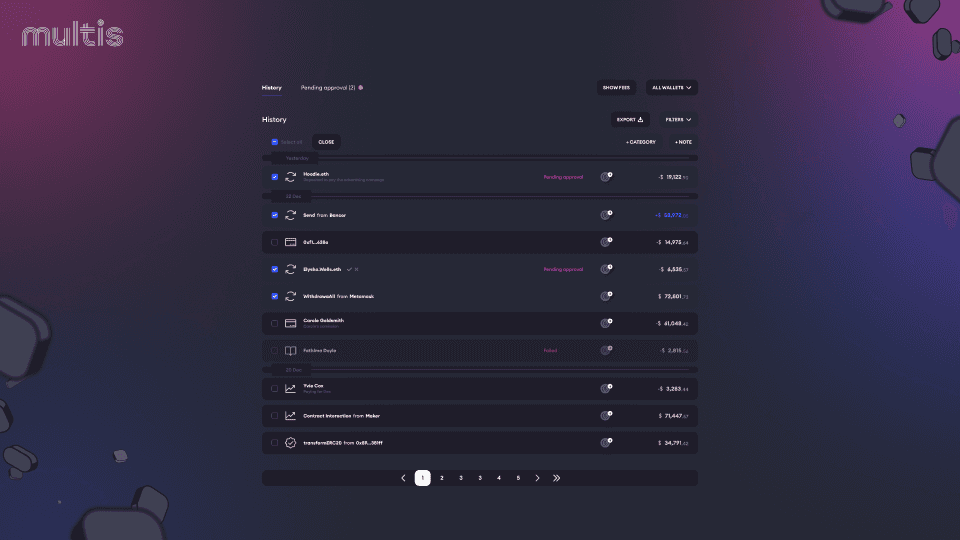

Easy Reporting

Multis accounts make reporting on finances easy. The “transactions” tab is a single source of truth where users can categorize their transactions across all wallets, add notes and attachments for added clarity, and export data as an accountant friendly CSV report.

Insights that are easy to share

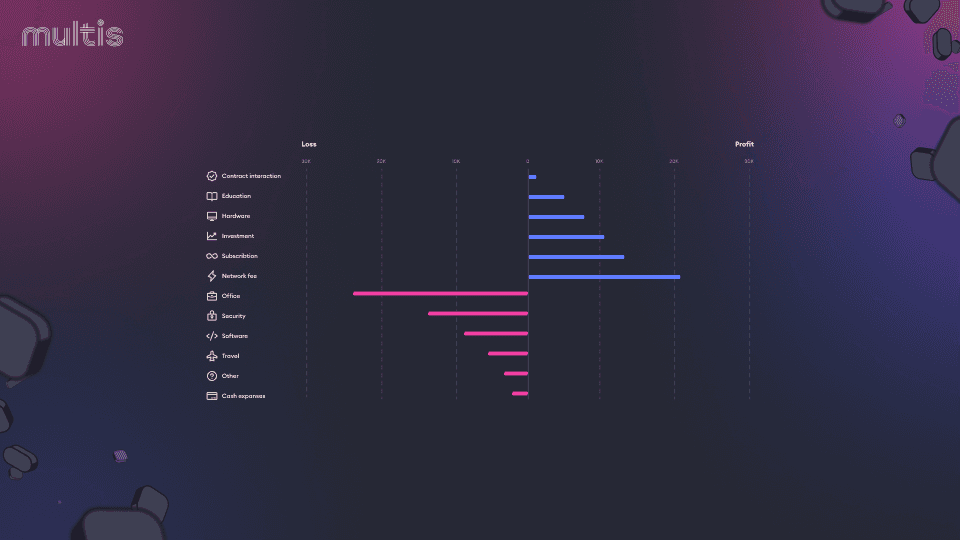

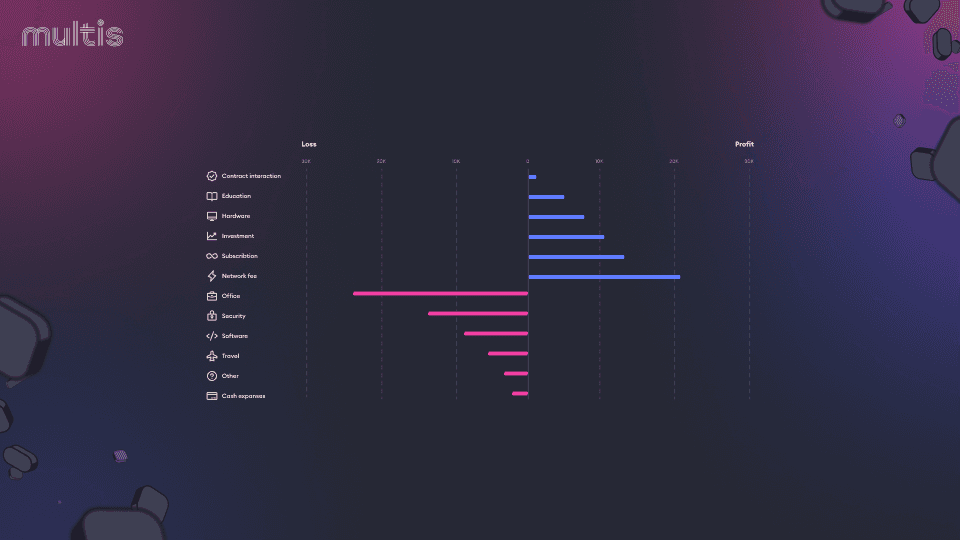

The “Insights” tab on Multis was designed to give users a snap shot understanding of basic KPIs: inflows and outflows over time, and a breakdown of expenses by categories. Unlike minute accounting data, these charts are made to give non-experts a view of funds for better transparency and easy decision making. We’ve already been told that some of our DAO users are taking screenshots of company Insights and sharing them with their community on Discord. We hope to make this feature more sharable in the future and better integrate DAO communities.

Payroll

Multis is designed to make DAO payments as easy as possible. That’s why accounts are equipped with payroll functions allowing to pay up to 65 addresses in a single transaction. Thanks to a built-in company address book- contacts are stored in a single place. Because our accounts are built on Gnosis Safe, users can put in place a payment approval policy, ensuring that outgoing payments are validated by multiple admins to ensure maximum transparency.

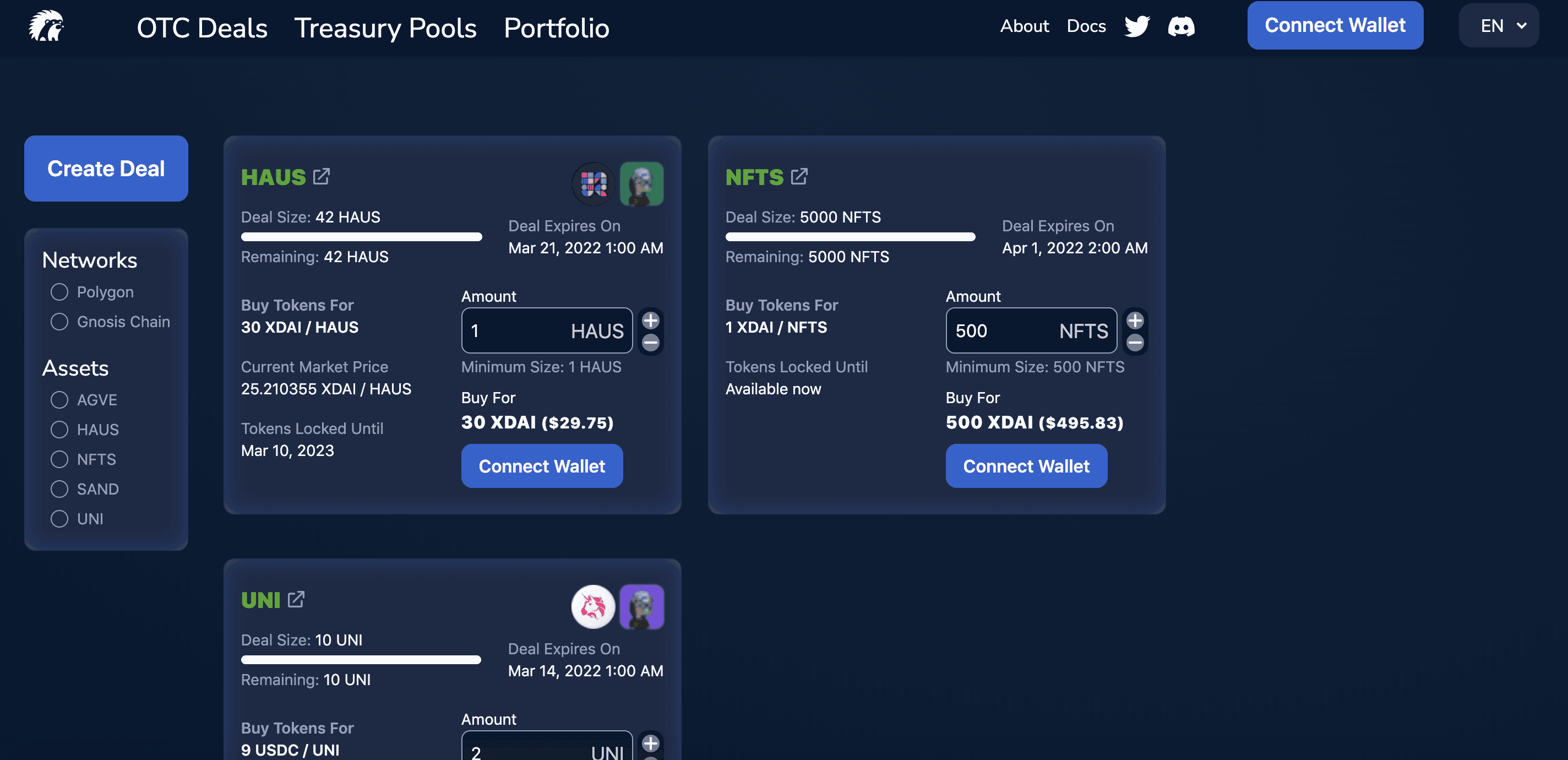

Hedgey: Optimizing DAO Treasury

Most DAO’s have over 95% of their treasury locked up in their native tokens. This is a huge risk: unless your token moons, a treasury made up of a volatile asset is highly risky- in a worst case scenario the DAO might end up selling it’s native token during a bear market. A best practice from traditional finance is of course to diversify their treasury with lower risk assets. Stablecoins are a perfect example of such an asset, however, selling native currency on a DEX can cause real price impacts. Hedgey is a permissionless protocol designed for DAOs to generate yield and diversify their treasuries without having to do spot sales on the open market. Hedgey lets users create t ime-locked OTC offers as transferable NFTS or generate upfront yield by writing covered calls with native treasury tokens directly from their app. This is a powerful tool that DAOs can use to protect their treasury long term and insulate it from fluctuations that come with a Bear market.

DAO Legal Tooling

Right now, most DAOs exist in a legal grey area- somewhere between a co-op and a small business. As DAOs continue to amass impressive treasuries and grow in number — it’s becoming an imperative to protect stakeholders from legal liability and to have an appropriate structure for looming taxation. The state of Wyoming is a pioneer in this area — allowing DAOs to set up as LLCs, the Marshall Islands has been following suit in this area as well.

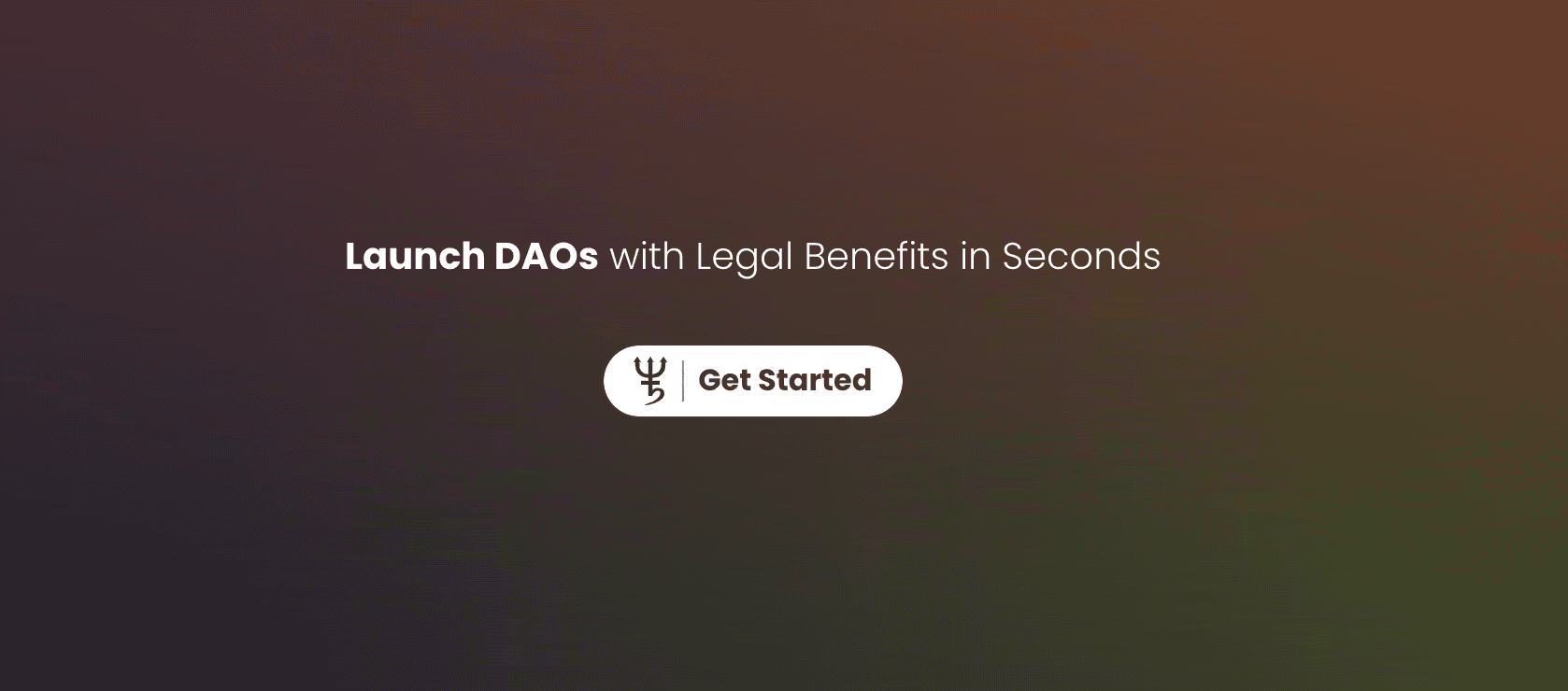

KaliDAO - Launching a DAO with legal benefits

KaliDAO is one of the most interesting projects we’ve seen for DAOs wishing to launch with a legal status. Spun off from the team at LexDAO, a group of legal engineers, KaliDAO allows DAO members to connect their wallet directly to their platform and to establish key preliminaries like voting structure and legal status, end-to-end tokenization, voting support, and LLC formation and drafting agreement software. At the moment, there are 4 types of agreements available Wyoming DAO LLC, Delaware DAO LLC, Unincorporated Non-Profit Association, and Investment Club. This is an amazing all-in-one way to protect a nascent DAO from day 1.

LexDAO - for a community of legal engineers

LexDAO does not offer legal advice. It’s a space for “legal engineering professionals” who are building blockchain projects that can be used in lieu of basic legal fees. They’ve also come up with a way to provide an arbitration service that renders a decision through a multi-sig committee of LexDAO legal engineers. Their blog provides interesting opinions on web3 legal disputes as well as explanations of legal implications of protocols. We should also mention that their directory of key contributors is a roster of many lawyers specializing in web3- for those looking for legal counsel on their DAO this could be a good jumping off point.

Antifirm - Web3 specialized Lawyers who get DAOs

Antifirm is the web3 arm of the law firm Campbell Teague. Unlike KaliDAO and LexDAO which do not provide legal advice, Antifirm provides counsel on everything from DAO structure, to NFT sales, to General Counsel.

DAO Governance Tooling

A key feature of DAOs is transparency in how decisions are made and funds allocated. Members often earn voting privileges through contributions to the DAO. Unlike typical corporations DAO stakeholders are empowered to submit proposals from all areas of the DAO: from grants, to engineering, to marketing, to events. The result of voting in DAOs means on-chain action.

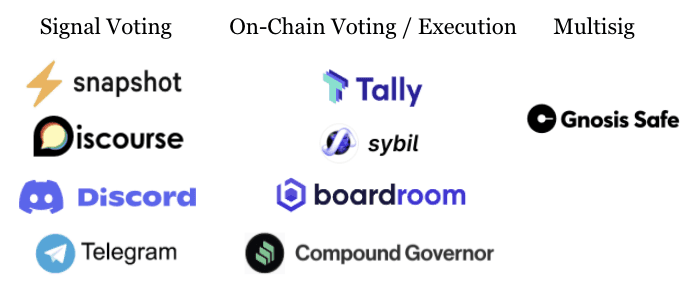

On-Chain Governance Voting Tooling

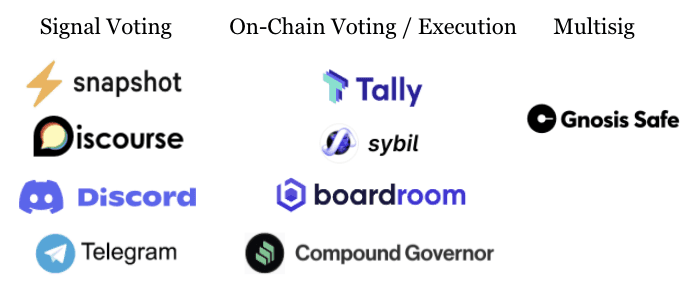

Historically, On-Chain voting tools were used to enable DAO governance and decision making. Tools that allow for this include Tally, Sybil (developed by Uniswap) Boardroom, and Compound Governor. However, due to volatile gas fees on Ethereum Mainne t it’s become increasingly common for DAOs to look for other tools for voting that will save them on gas fees.

Offchain/Signal Voting Tools

Oftentimes, DAOs will use offchain social networks like Discord and Telegram for simple polling as these tools are often integral to the DAOs community. Snapshot also offers off-chain and gasless voting systems that can be adapted to different systems (quadratic voting, approval voting, etc).

DAO Tooling Starts with a Mindset

As Vitalik Buterin stated “You can’t just have a DAO to be a DAO. You need a DAO to do something.” The most vibrant DAOs are building exchanges, turning legal services into code, making web3 easier to use, and funding culturally significant digital art.

However, as a company we recommend that from the outset nascent DAOs take what they’re doing seriously. This starts with selecting the right tools to accomplish treasury management, assure legal status, and make governance easy to enact. In order for a DAO to do great things, tools need to be part of the conversation early on. In many ways, we’re talking mindset, and an openness to a certain degree of centralization (especially when it comes to tracking assets in your portfolio). Any DAO should try to put in place tools and ways of working to ensure the future success and prosperity of the organization.

Did we leave out any tools? Let us know support@multis.co.

DAOs: huge potential but limited tooling

According to the experts, we’re right now in the year of the DAO (or Decentralized Autonomous Organization). As of February 2022, there are at least 188 DAOs controlling over $12 billion in assets. These organizations have huge potential: they’re digitally native, transparent by design and their community-led ethos means they can often scale faster than traditional top-down organizations. However, a major block in running a DAO is a lack of tooling that can allow for efficient treasury management, payouts, reimbursement, and smooth governance. Traditional businesses have a wide range of Saas products, and business apps to support their operations, in addition to corps of lawyers and accountants specializing in startups and small businesses. This is not yet the case in the web3 world. Below you’ll find some solutions that we’ve seen our users implement and in order to improve upon tools and to create solutions whole cloth.

DAO Treasury Management: Emerging Tooling to cover the basics and to diversify

Nearly all DAOs store their treasury on multisignature wallets, which are built for teams. Although there are a wide array of multisignature wallets, Gnosis Safe is the de-facto multisignature wallet for DAOs. Most DAOs lock up their assets on multiple multisignature wallets and disburse treasury to individual wallets for coindrops or allocating grant funding. We spoke to a member of a grants committee at a major DAO and he summed it up saying “My biggest issue is that most DAO contributors have no understanding of treasury management at all. Lots of funds sit idle because the most important thing with treasury is knowing how to use it.”

Multis: DAO Tooling for Treasury & Cashflow Monitoring

One of the reasons we built Multis was to give DAOs and web3 organizations clarity and control over their crypto treasury. We’ve built our app on Gnosis Safe because not only do we think it’s the gold standard for Multisig wallets but also because DAOs can simply connect their existing safes and access the app. No need to transfer funds to a new wallet.

Monitoring Finances and Getting Company Metrics

Multis allows teams to track financial activity of wallets across ETH, BNB, Polygon, and BTC. DAOs can link as many wallets as they are using for a holistic overview of their funds. This can be a crucial way for DAOs to make complex financial information easier to read and to understand. Visualizing company treasury over time and by category can help teams make better decisions about cashflow and budgeting and is a crucial step towards getting a handle on your DAO’s treasury.

Community access

Unlike a Gnosis Safe, where only “owners” can access funds on the wallet, Multis accounts include a teammate-level access. Meaning that non-owners can still see activity on the wallet, label transactions, and export financial data.

Easy Reporting

Multis accounts make reporting on finances easy. The “transactions” tab is a single source of truth where users can categorize their transactions across all wallets, add notes and attachments for added clarity, and export data as an accountant friendly CSV report.

Insights that are easy to share

The “Insights” tab on Multis was designed to give users a snap shot understanding of basic KPIs: inflows and outflows over time, and a breakdown of expenses by categories. Unlike minute accounting data, these charts are made to give non-experts a view of funds for better transparency and easy decision making. We’ve already been told that some of our DAO users are taking screenshots of company Insights and sharing them with their community on Discord. We hope to make this feature more sharable in the future and better integrate DAO communities.

Payroll

Multis is designed to make DAO payments as easy as possible. That’s why accounts are equipped with payroll functions allowing to pay up to 65 addresses in a single transaction. Thanks to a built-in company address book- contacts are stored in a single place. Because our accounts are built on Gnosis Safe, users can put in place a payment approval policy, ensuring that outgoing payments are validated by multiple admins to ensure maximum transparency.

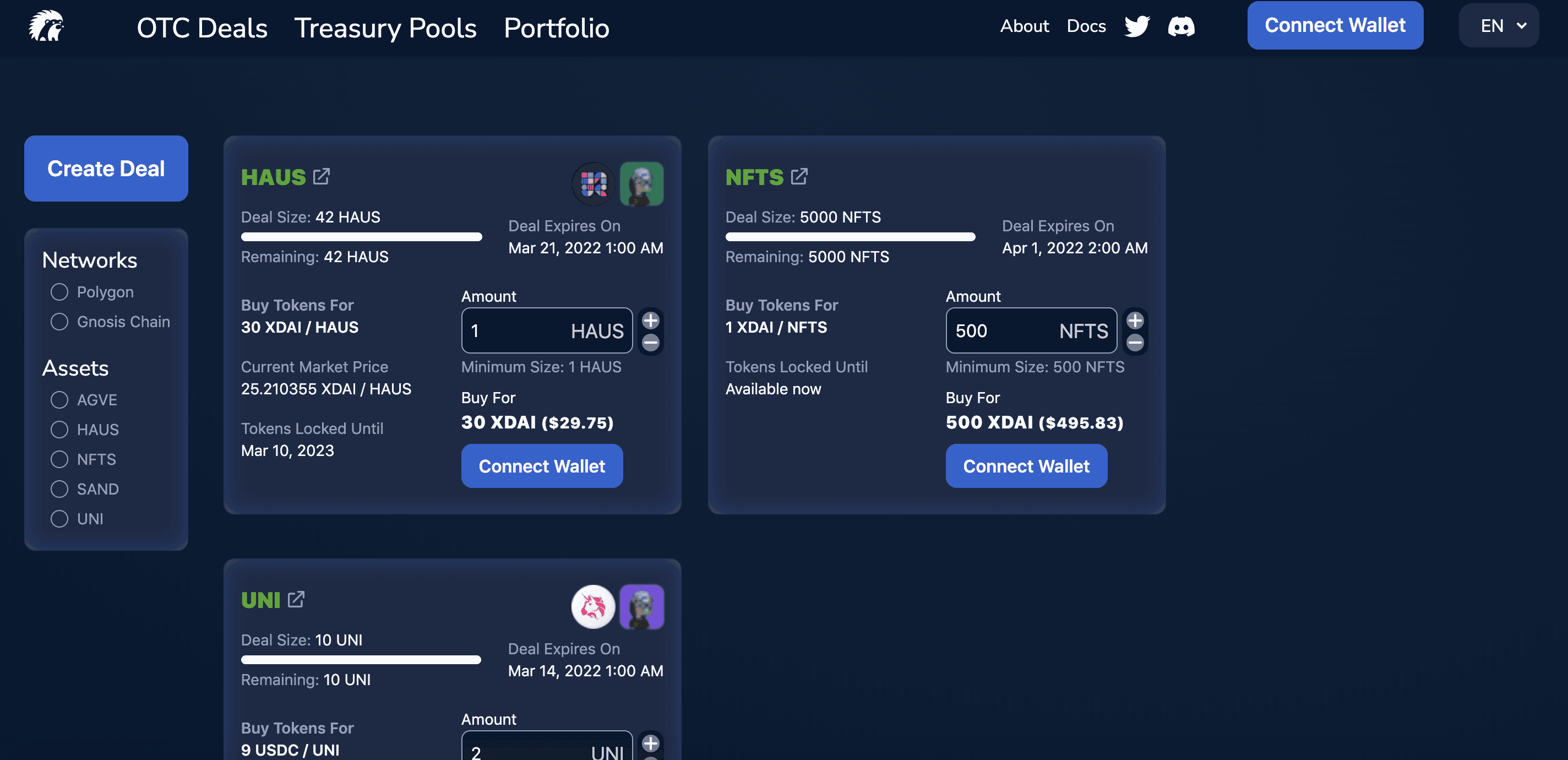

Hedgey: Optimizing DAO Treasury

Most DAO’s have over 95% of their treasury locked up in their native tokens. This is a huge risk: unless your token moons, a treasury made up of a volatile asset is highly risky- in a worst case scenario the DAO might end up selling it’s native token during a bear market. A best practice from traditional finance is of course to diversify their treasury with lower risk assets. Stablecoins are a perfect example of such an asset, however, selling native currency on a DEX can cause real price impacts. Hedgey is a permissionless protocol designed for DAOs to generate yield and diversify their treasuries without having to do spot sales on the open market. Hedgey lets users create t ime-locked OTC offers as transferable NFTS or generate upfront yield by writing covered calls with native treasury tokens directly from their app. This is a powerful tool that DAOs can use to protect their treasury long term and insulate it from fluctuations that come with a Bear market.

DAO Legal Tooling

Right now, most DAOs exist in a legal grey area- somewhere between a co-op and a small business. As DAOs continue to amass impressive treasuries and grow in number — it’s becoming an imperative to protect stakeholders from legal liability and to have an appropriate structure for looming taxation. The state of Wyoming is a pioneer in this area — allowing DAOs to set up as LLCs, the Marshall Islands has been following suit in this area as well.

KaliDAO - Launching a DAO with legal benefits

KaliDAO is one of the most interesting projects we’ve seen for DAOs wishing to launch with a legal status. Spun off from the team at LexDAO, a group of legal engineers, KaliDAO allows DAO members to connect their wallet directly to their platform and to establish key preliminaries like voting structure and legal status, end-to-end tokenization, voting support, and LLC formation and drafting agreement software. At the moment, there are 4 types of agreements available Wyoming DAO LLC, Delaware DAO LLC, Unincorporated Non-Profit Association, and Investment Club. This is an amazing all-in-one way to protect a nascent DAO from day 1.

LexDAO - for a community of legal engineers

LexDAO does not offer legal advice. It’s a space for “legal engineering professionals” who are building blockchain projects that can be used in lieu of basic legal fees. They’ve also come up with a way to provide an arbitration service that renders a decision through a multi-sig committee of LexDAO legal engineers. Their blog provides interesting opinions on web3 legal disputes as well as explanations of legal implications of protocols. We should also mention that their directory of key contributors is a roster of many lawyers specializing in web3- for those looking for legal counsel on their DAO this could be a good jumping off point.

Antifirm - Web3 specialized Lawyers who get DAOs

Antifirm is the web3 arm of the law firm Campbell Teague. Unlike KaliDAO and LexDAO which do not provide legal advice, Antifirm provides counsel on everything from DAO structure, to NFT sales, to General Counsel.

DAO Governance Tooling

A key feature of DAOs is transparency in how decisions are made and funds allocated. Members often earn voting privileges through contributions to the DAO. Unlike typical corporations DAO stakeholders are empowered to submit proposals from all areas of the DAO: from grants, to engineering, to marketing, to events. The result of voting in DAOs means on-chain action.

On-Chain Governance Voting Tooling

Historically, On-Chain voting tools were used to enable DAO governance and decision making. Tools that allow for this include Tally, Sybil (developed by Uniswap) Boardroom, and Compound Governor. However, due to volatile gas fees on Ethereum Mainne t it’s become increasingly common for DAOs to look for other tools for voting that will save them on gas fees.

Offchain/Signal Voting Tools

Oftentimes, DAOs will use offchain social networks like Discord and Telegram for simple polling as these tools are often integral to the DAOs community. Snapshot also offers off-chain and gasless voting systems that can be adapted to different systems (quadratic voting, approval voting, etc).

DAO Tooling Starts with a Mindset

As Vitalik Buterin stated “You can’t just have a DAO to be a DAO. You need a DAO to do something.” The most vibrant DAOs are building exchanges, turning legal services into code, making web3 easier to use, and funding culturally significant digital art.

However, as a company we recommend that from the outset nascent DAOs take what they’re doing seriously. This starts with selecting the right tools to accomplish treasury management, assure legal status, and make governance easy to enact. In order for a DAO to do great things, tools need to be part of the conversation early on. In many ways, we’re talking mindset, and an openness to a certain degree of centralization (especially when it comes to tracking assets in your portfolio). Any DAO should try to put in place tools and ways of working to ensure the future success and prosperity of the organization.

Did we leave out any tools? Let us know support@multis.co.